In Swedish, “klarna” means to clear up or become better. As in, the skies are now rainy, but if the weather clears up, we can hit the beach. That explains the name of the buy-now-pay-later behemoth Klarna. It’s now ubiquitous with online shopping — you’ll see Klarna at checkout whether you’re buying a new laptop from Microsoft or a pair of Nikes you probably shouldn’t buy. But thanks to Klarna, you can break up the purchase into more affordable payments. Brighter times ahead, indeed.

As more shoppers embrace Klarna’s buy-now-pay-later services, it’s important to understand the security implications. Can you trust the platform to keep payment and contact information secure?

As digital security experts, we know security is a high priority, so we took a closer look. Below you’ll find all the details on what we discovered about Klarna.

Facts About Klarna

| Who owns Klarna? | Klarna Group |

|---|---|

| When was Klarna founded? | 2005 |

| Where is Klarna headquartered? | Stockholm, Sweden |

| How many active users does Klarna have? | Over 100 million active users |

Is Klarna Safe?

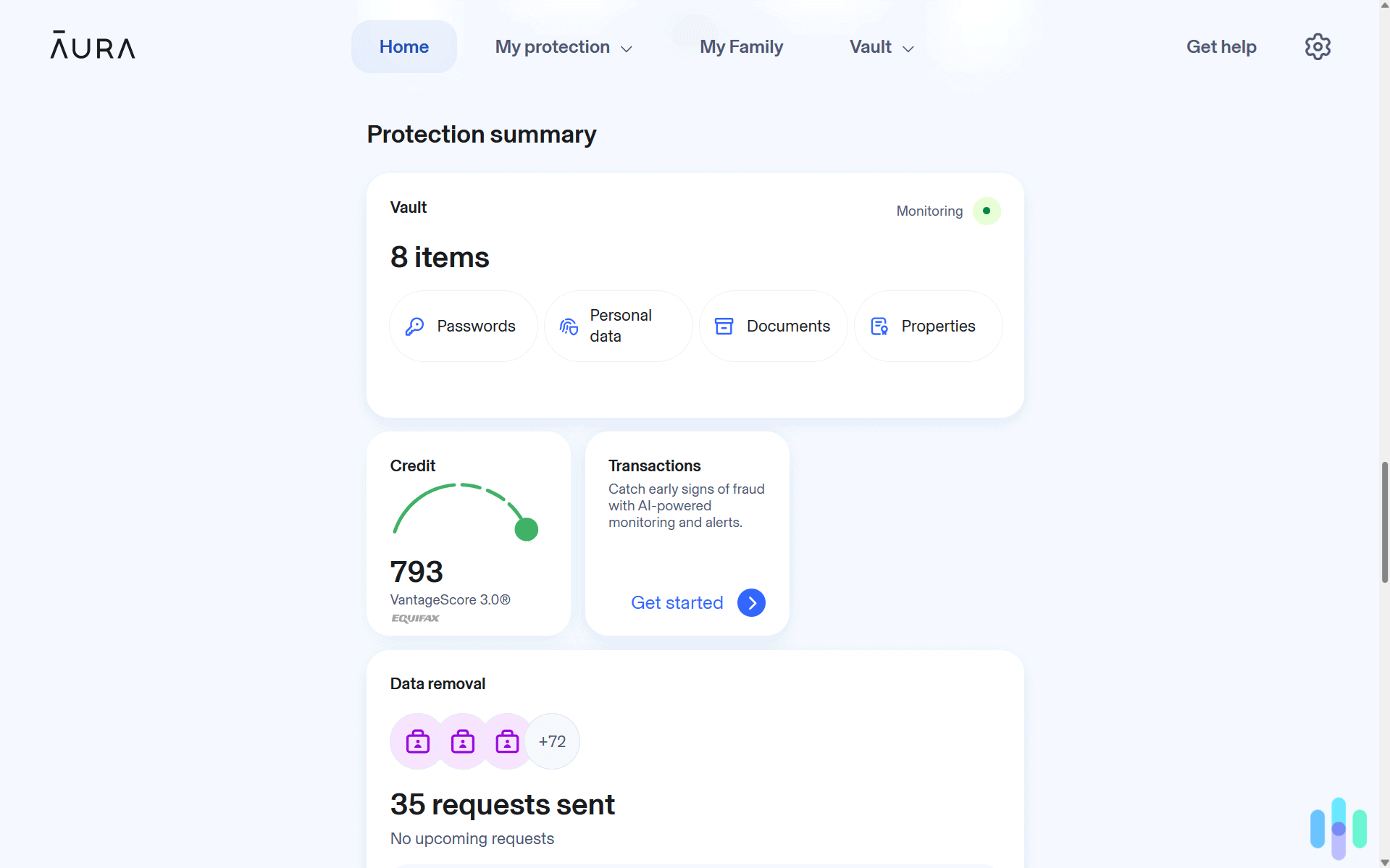

The short answer? Yes, Klarna is generally safe to use. The platform employs bank-level security measures, including 256-bit encryption, two-factor authentication, and real-time fraud monitoring. In fact, Klarna holds banking licenses in Sweden and the UK, meaning it must comply with strict financial regulations that protect consumers.1

Klarna’s privacy policy emphasizes the importance of keeping your data safe and making sure you can be in control of the data you share. “After all, your data belongs to you,” Klarna says on its website. The company also gives you the option to decline providing personally identifiable information, but you won’t be able to use Klarna Services if you choose to do so.

>> Also See: Is Credit Karma Safe?

Once you download and boot up Klarna, it’s good to keep in mind best practices while using the app. That includes keeping an eye out for phishing scams and their brilliantly named twins: vishing (voice scams) and smishing (SMS scams). But you won’t find many platforms safer than Klarna.

Did You Know: Recent FTC data shows a 400 percent increase in imposter scams resulting in over $400 million in losses in 2024.2 To avoid these scams, always verify the sender of messages requesting personal information and never click links or download attachments from unknown senders.

How Does Klarna Keep You Safe?

Klarna implements multiple layers of security to protect your personal and financial information. Here’s a break down of each security layer:

- Encryption protects all payment information using TLS 1.3 protocols, the same security standard used by major financial institutions. Your card details are tokenized, meaning merchants never see your actual payment information.

- Klarna also maintains other physical, technical, administrative, and procedural safeguards to protect personal information.

- All transactions take place through secure connections following strict security protocols.

- You can remove your linked bank account or card at any time.

- Real-time fraud detection uses machine learning algorithms to flag suspicious activity.

- Biometric authentication options, including Face ID and fingerprint scanning, add an extra security layer when accessing your account on mobile devices.

An Overview of Klarna’s Privacy Policy

Klarna’s privacy policy discloses their data collection and usage practices. The company operates under the GDPR in Europe and follows similar data protection standards globally.

It begins by sharing what kind of data Klarna collects. That can be broken up into two categories: personally identifiable information (PII) and non-personally identifiable information.

FYI: PII is any information that can identify you, including an email address, telephone number, postal address, IP address, geolocation information, or financial information.

Klarna also may collect personally identifiable information about you from third parties such as data vendors, as well as non-personally identifiable information including demographic information and general location information.

The company collects the following information:

- Data users provided by the platform

- Usage data

- Customer-support communications

- Other communication with Klarna

- Data from third parties

- Website and mobile usage data provided by cookies

- Device fingerprinting information for fraud prevention

- Transaction history and spending patterns for credit assessment

Did You Know: Cookies are small files stored on your computer or device. They record your preferences and the actions you take on those devices.

It’s worth noting that Klarna’s browser extensions, available for Chrome, Edge, Safari, and Firefox, collect browsing data to provide price comparisons and deal alerts. You can control these permissions in your browser settings.

Keeping Safe While Using Klarna

Before you make your first Klarna purchase, here are essential security measures to ensure the security of your account:

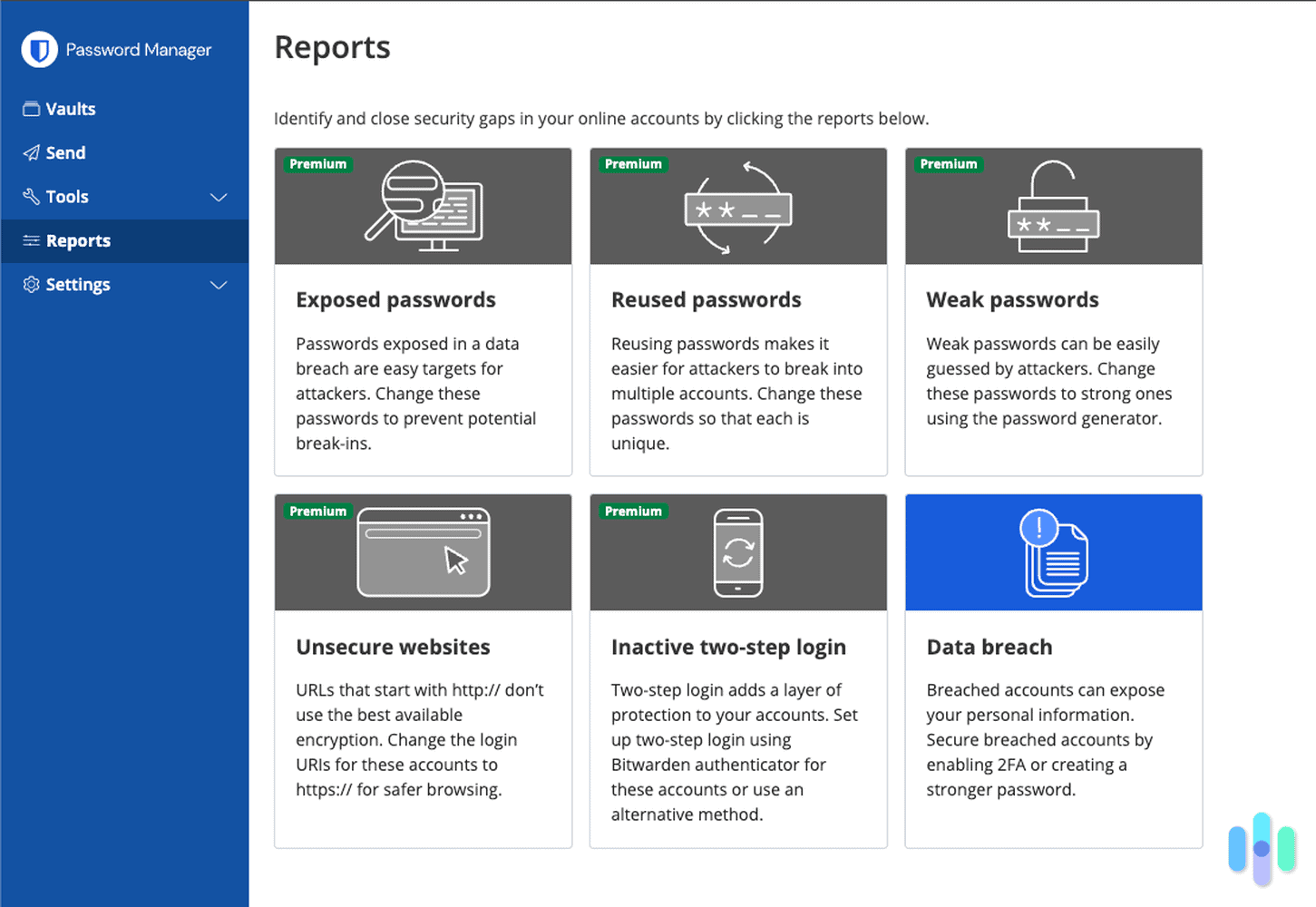

- Keep your password safe. It’s your Fort Knox. When you use Klarna, protect yourself against unauthorized access by signing out after using a shared computer. Choose a strong password that nobody else knows or can easily guess, and keep your login information and password private. Consider using a passphrase of at least 16 characters with a mix of uppercase, lowercase, numbers, and symbols.

>> Related Reading: Best Password Managers of 2025

- Enable two-factor authentication (2FA). Klarna offers 2FA through SMS or authenticator apps. This simple step blocks 99 percent of automated attacks.3

- Beware of spoof or phishing emails. These kinds of emails and text messages will appear to be from Klarna, but they’re not. They’re sent with the goal of accessing sensitive information such as passwords. Real Klarna emails always come from @klarna.com addresses and never ask for passwords or PIN codes.

- Use a VPN. Ah, VPNs. VPN stands for virtual private network. They provide an extra layer of protection when you’re online, encrypting your online activity and assigning your device an anonymous IP address so you can’t be tracked. When you use a VPN, no one else will know what you’re doing online.

Expert Tip: We recently compiled a list of the best VPNs of 2025. After testing dozens of the top options, we whittled them down to the top 10.

- Watch out for malware. It’s always a good idea to invest in a good antivirus program to keep yourself safe from malware. Failing to do so is one way your device could become exposed, leaving your data and passwords vulnerable. To help protect against that threat, scan file attachments using one of the best antivirus services.

- Monitor your credit regularly. Since Klarna reports to credit bureaus, keeping tabs on your credit report helps you spot any unauthorized accounts opened in your name.

Bottom Line: Should You Use Klarna?

After putting Klarna through our security gauntlet, we can confidently say it’s one of the safer BNPL services. The platform processes over two million transactions per day while maintaining robust security standards that rival traditional banks.

Based on our extensive security experience, Klarna definitely holds up — bolstered by features such as strong encryption, 24/7 monitoring, and data protection. Klarna works hard to keep your account safe and secure. Another thing we liked about Klarna is what it does if you decide to delete the platform. Klarna promises to delete your personal data (although it may retain certain data even after your deletion request).

To top it off, Klarna employs dedicated data-protection officers, who you can contact for any data-protection issues. The service is available by chat through Klarna’s website or app. Klarna also has a 24/7 phone hotline for those issues. You can access it on Klarna’s contact page.

>> Check Out: Is Cash App Safe?

Frequently Asked Questions

Before we end this report on Klarna’s safety, let’s answer some frequently asked questions about the service.

-

Can I get refunds with Klarna?

If you’ve fully or partially paid for a purchase up front, Klarna will refund your payment if the return claim is resolved in your favor. In the event of any refunds, Klarna sends the funds to the same source you used to make payments.

-

Does Klarna sell your information?

Klarna doesn’t provide data to third parties for financial benefit. The company’s privacy policy is updated regularly, though, so you should keep updated on it so you’re aware of the latest changes.

-

Has Klarna ever been hacked?

In the spring of 2021, Klarna experienced a data breach caused by a faulty configuration change in its app. For a brief period, some users saw a subset of their information exposed to other app users. No changes, updates, or payments could be made by a user on another user’s account, though, and no card or account details were exposed. Since then, Klarna has implemented additional security audits and now conducts quarterly penetration testing to prevent similar incidents.

-

Is it safe to give Klarna your bank information?

Online bank details are entered entirely in Klarna’s secure payment form, which merchants can never access. Klarna uses Open Banking protocols and is PCI DSS Level 1 certified, the highest level of payment security certification available.

-

Who owns Klarna?

Klarna is owned by Klarna Group, its parent company. Klarna was founded in Stockholm in 2005 by Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson. The company is backed by investors such as Sequoia Capital, Visa, and Silver Lake.

-

Does using Klarna affect my credit score?

Klarna performs soft credit checks for Pay in 4 purchases, which don’t affect your credit score. However, financing options may require hard credit checks, and missed payments can be reported to credit bureaus, potentially impacting your score.