Allstate Identity Theft Protection Review

Is your identity in good hands with Allstate?

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on Oct 30, 2025

Gabe Turner, Chief Editor

Last Updated on Oct 30, 2025

What We Like

- 90-year reputation

- Digital Footprint monitoring service

- Social media monitoring

What We Don't Like

- Only uses one credit agency

- Provides no credit reports or scores

- Doesn’t specify how identity monitoring works

Bottom Line

Allstate has been protecting people and property for nearly a century. Recently, they’ve expanded into the digital realm with identity theft protection. They take a proactive approach to safeguarding their customers’ personal information with comprehensive digital protections through Allstate Blue.

But does their identity protection service live up to the “good hands” promise? We tested it to find out if it’s worth your consideration. Let’s dive in.

Monitoring Features

| Dark web monitoring for individuals | $9.99-$17.99/month |

|---|---|

| Dark web monitoring for families | $18.99-$34.99/month |

| Personal information leak alerts | Yes |

| Email address leak alerts | Yes |

| Credit card information leak alerts | Yes |

- Family, individual, and business plans available

- 30-day free trial for all personal plans

- Monthly contracting

Where Allstate Stands In The Market

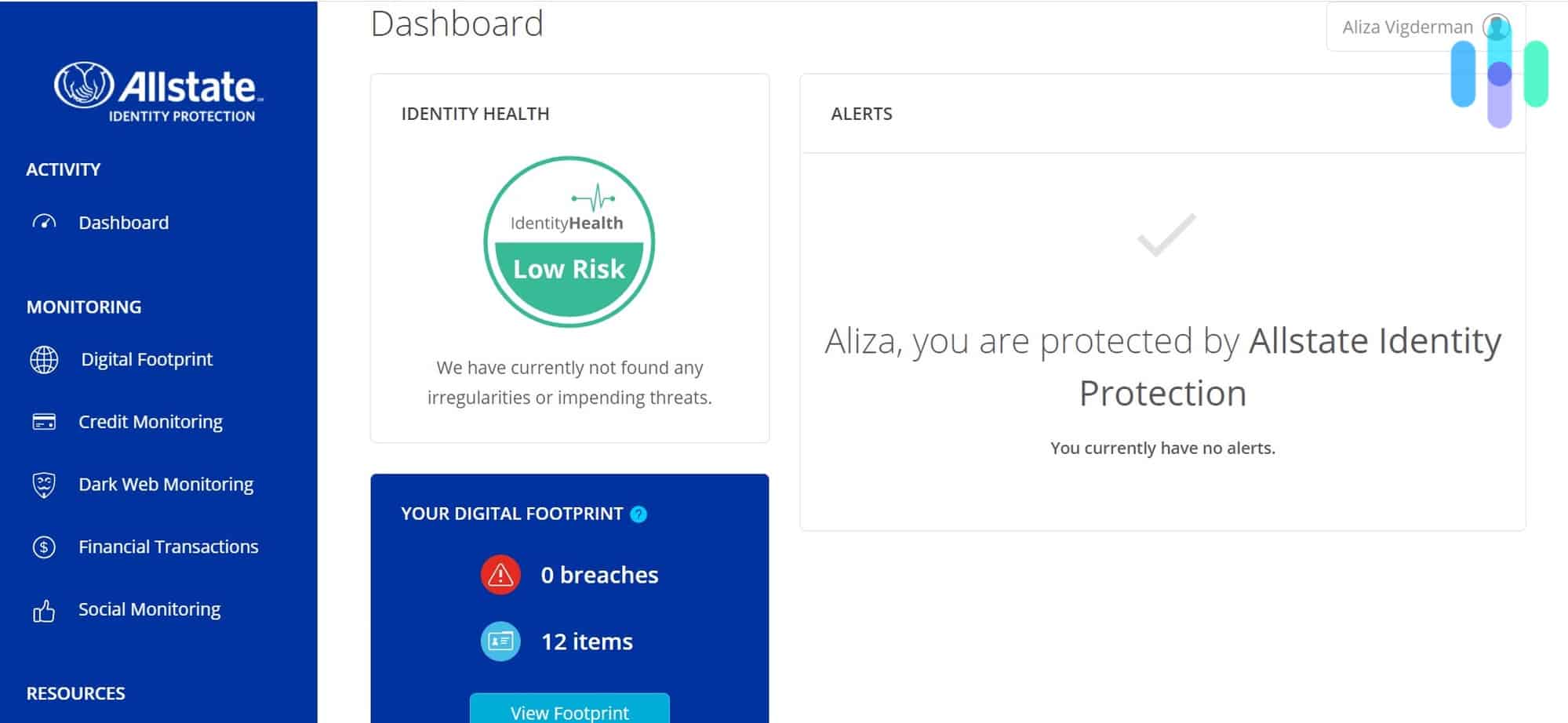

Allstate offers reliable identity theft service, but it’s still lacking in some areas. One of the things we noticed was its lack of three-bureau credit monitoring, an important feature we saw from our top three identity protection services below:

Features

On the surface, Allstate Identity Theft Protection covers all the areas a good identity theft protection service should, offering the most important features we list in our identity theft protection guide. These include financial monitoring, identity monitoring, and social media monitoring. However, upon closer look, their coverage was spotty, especially for financial monitoring. Below, we break down just what they offer in each category.

Financial Monitoring

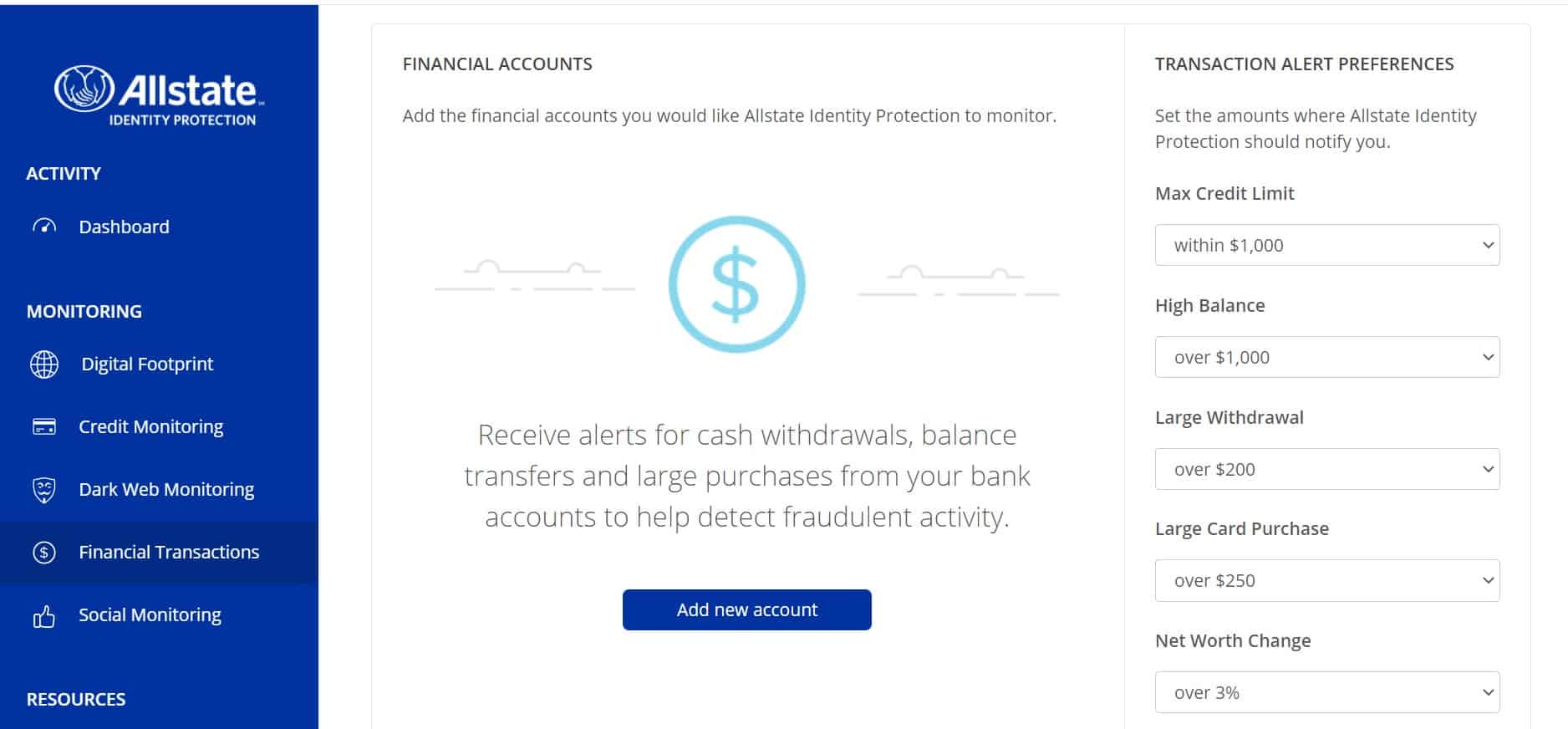

Allstate Identity Protection monitored our financial activity across a number of key categories.

- Credit monitoring: Allstate did monitor our credit using one of the big three consumer credit reporting unions, TransUnion, and they sent us alerts when they noticed any suspicious activity or unusual changes. However, most companies use all three services, including Experian and Equifax, so we were a bit disappointed.

- Student loan monitoring: Allstate kept up with our student loan activity, making sure that no one decided to run up our tab. Good thing, too, since it’s high enough as it is.

- Credit card monitoring: Once we entered all of our credit card information in our dashboard, Allstate sent us alerts about any unusual purchases.

- Bank account monitoring: Allstate also kept an eye on all of our bank accounts, looking for large or uncharacteristic withdrawals.

- 401(k) monitoring: Retirement funds are the last thing we want anyone messing with. Luckily, Allstate had these covered too, making sure no one made any early withdrawals.

- High-risk transaction monitoring: Finally, as a catchall, Allstate promised to be on the lookout for any transactions that seemed risky or out of character across all of our various financial accounts.

Allstate monitored all of these areas and sent us alerts if they noticed a problem, but they didn’t actually provide us with credit reports or scores as most identity theft services do. These scores can be helpful when it comes time to apply for loans or credit cards, so we were pretty disappointed not to have access to this information.

Pro Tip: It is best to keep track of all three of your credit scores, since different creditors will report different information to each bureau. Knowing your scores with all three major credit bureaus makes you less likely to miss any problems.

Identity Monitoring

Allstate monitored our identity, promising to keep track of any identifying information we gave them, including Social Security numbers, driver’s license numbers, birthdates, and addresses. They noted any suspicious activity anywhere on the web, with their service specifically including dark web monitoring. The dark web is where most stolen data is bought and sold, so Allstate constantly scanned these sites to make sure our data never came up in anyone’s checkout cart.

Social Media Monitoring

Available with Premier and Blue subscriptions, Social media monitoring involves regular scans of your LinkedIn, Twitter (now X), Facebook, Instagram, and YouTube accounts. If Allstate finds anyone posting anything potentially offensive or potentially damaging to your reputation, it sends you a notification. More importantly, they’ll alert you immediately if someone manages to take over your accounts altogether.

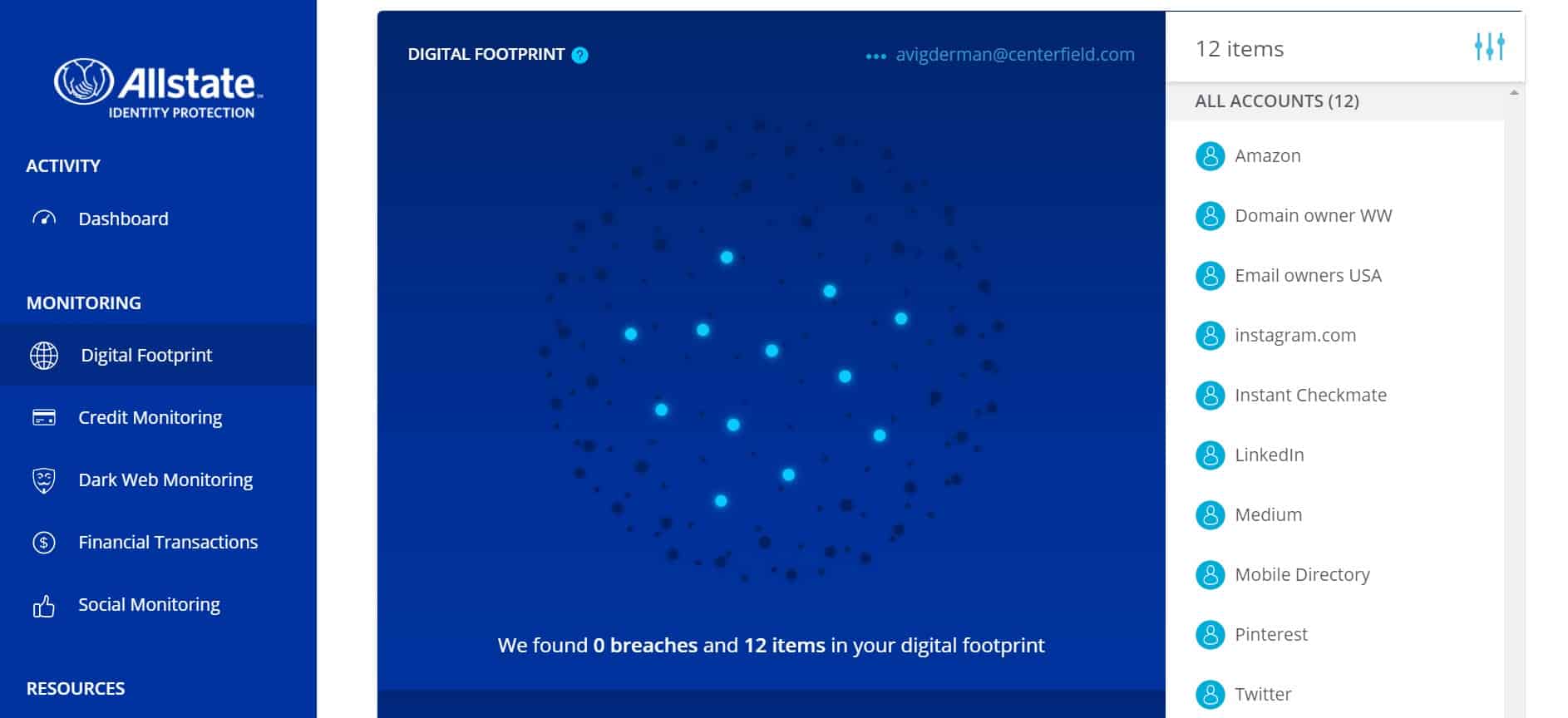

Digital Footprint

Allstate’s Digital Footprint monitoring feature comprehensively scans the web for every account associated with your name. That includes everything from banking services to shopping sites. This uncovers accounts you forgot about entirely. For example, they found an old savings account we’d opened decades ago with just a few dollars in it – not much, but still worth knowing about. They also alert you if any of these accounts have been compromised in a breach. Once we knew about all our accounts, it was much easier to manage them all.

FYI: The average person has about 170 online accounts.1Since most people use the same password for multiple accounts, forgotten accounts are particularly vulnerable to breaches

Full-Service Remediation and Insurance

Of course, all this monitoring was great, but we wanted to know what Allstate would do for us if we actually had a serious problem. It turned out that Allstate Identity Protection came with full-service assistance that would cover any instances of identity theft or stolen funds. This assistance included:

- Account professionals: Allstate’s experts handle cases of identity theft from start to finish. This can include contacting the police and even recovering stolen funds.

- Stolen funds reimbursement: Allstate offers reimbursement of up to $1 million for stolen funds depending on your plan.

- Out-of-pocket reimbursement: The company provides up to $1 million reimbursement for out-of-pocket expenses incurred as a result of identity theft (up to $2 million with family plans).

- Tax refund coverage: Allstate replaces tax refund money immediately if a check is stolen.

- Lost wallet services: Finally, Allstate helps cancel credit cards and replace IDs and documents in the event of a lost or stolen wallet.

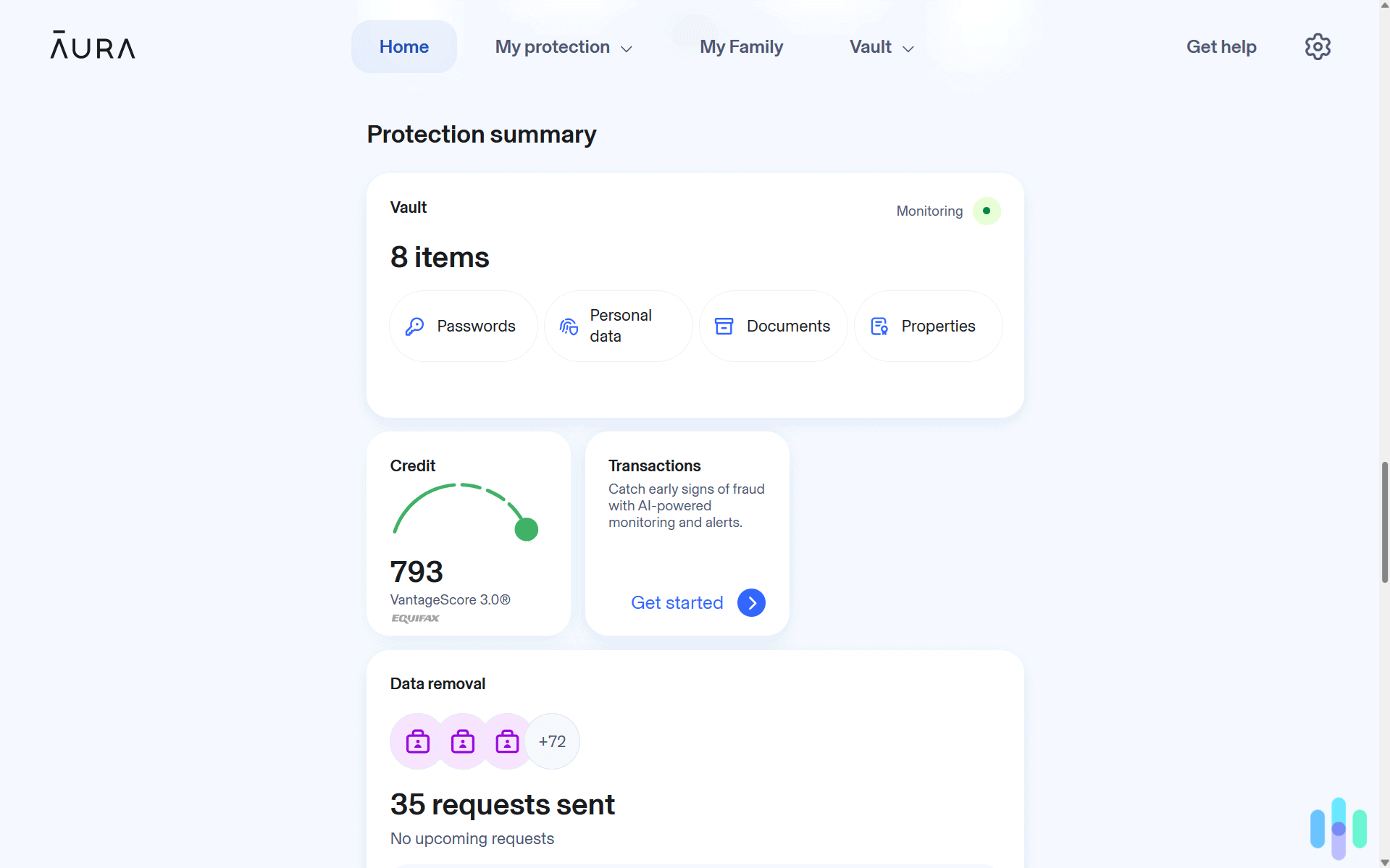

The Allstate Dashboard

The Allstate online dashboard was easy and straightforward. The homepage featured three boxes showing our identity health, a summary of our Digital Footprint, and all our current alerts. We liked having all the important information right up front in plain English the moment we signed on. On the left-hand side of the page was a menu listing additional items to explore. This included links to:

- Digital Footprint

- Credit monitoring

- Dark web monitoring

- Financial transactions

- Social media monitoring

Most of these items needed to be set up before we could really use the service. For example, we needed to tell Allstate where we had social media accounts before they could start monitoring them. But the site prompted us to go through these processes the first time we signed on, and they took less than five minutes to complete.

We also had the option to tinker with some of the settings. For instance, we set the financial transaction monitor so that we received alerts only for charges to our account over $1,000. After all, we don’t need to get emails every time we buy a gallon of milk.

The account settings were just as easy to adjust. We found a link in the upper right-hand corner of the homepage that took us to a complete rundown of our settings. Most of these settings were pretty straightforward, allowing us to change information like our email and our password. There was also an option for how to get alerts: email, text message, or both. We like plenty of warning when there’s a problem, so naturally, we chose both.

Allstate’s Apps

While the Allstate Identity Protection (AIP) app for both Android and iOS devices is free to download, you’ll need an active subscription to access its features. We like the app’s quick access to your dashboard. That makes it easy to check alerts and monitor your identity health on the go.

However, the app has limited functionality compared to the web portal. You can view information but can’t make significant account changes. Additionally, the app doesn’t receive regular updates, which can impact its performance and compatibility with newer devices.

Privacy Policy

We examined Allstate’s privacy policy carefully. According to their documentation, they collect:

- Names, addresses, and other important identifying information

- IP addresses

- Device information and usage data

Allstate states they don’t sell your personal information to third parties. They do share data with business partners and service providers necessary for delivering their monitoring services. This is standard practice in the industry, though we’d prefer more transparency about exactly which partners receive access to our data.

The Cost of Allstate’s Protection

Allstate offers three tiers of identity theft protection, each available for individuals or families. Pricing is competitive with the industry, though you’ll want to compare features carefully to ensure you’re getting the coverage you need. If you’re looking to protect the whole clan, you might be interested in reading our guide to the best family identity theft protections available today.

| Features | Essentials | Premier | Blue |

|---|---|---|---|

| Identity Monitoring | Yes | Yes | Yes |

| Fraud Protection | Yes | Yes | Yes |

| Credit Bureau Monitoring | 1 Bureau | 1 Bureau | 3 Bureau |

| Full Service Remediation | Yes | Yes | Yes |

| Identity Theft Expense Insurance | $1M | $1M | $1M ($2M with Family Plan |

| Stolen Funds Reimbursement | $50K | $500k | $1M |

| Privacy Management | Yes | Yes | Yes |

| Advanced Fraud Protection | No | Yes | Yes |

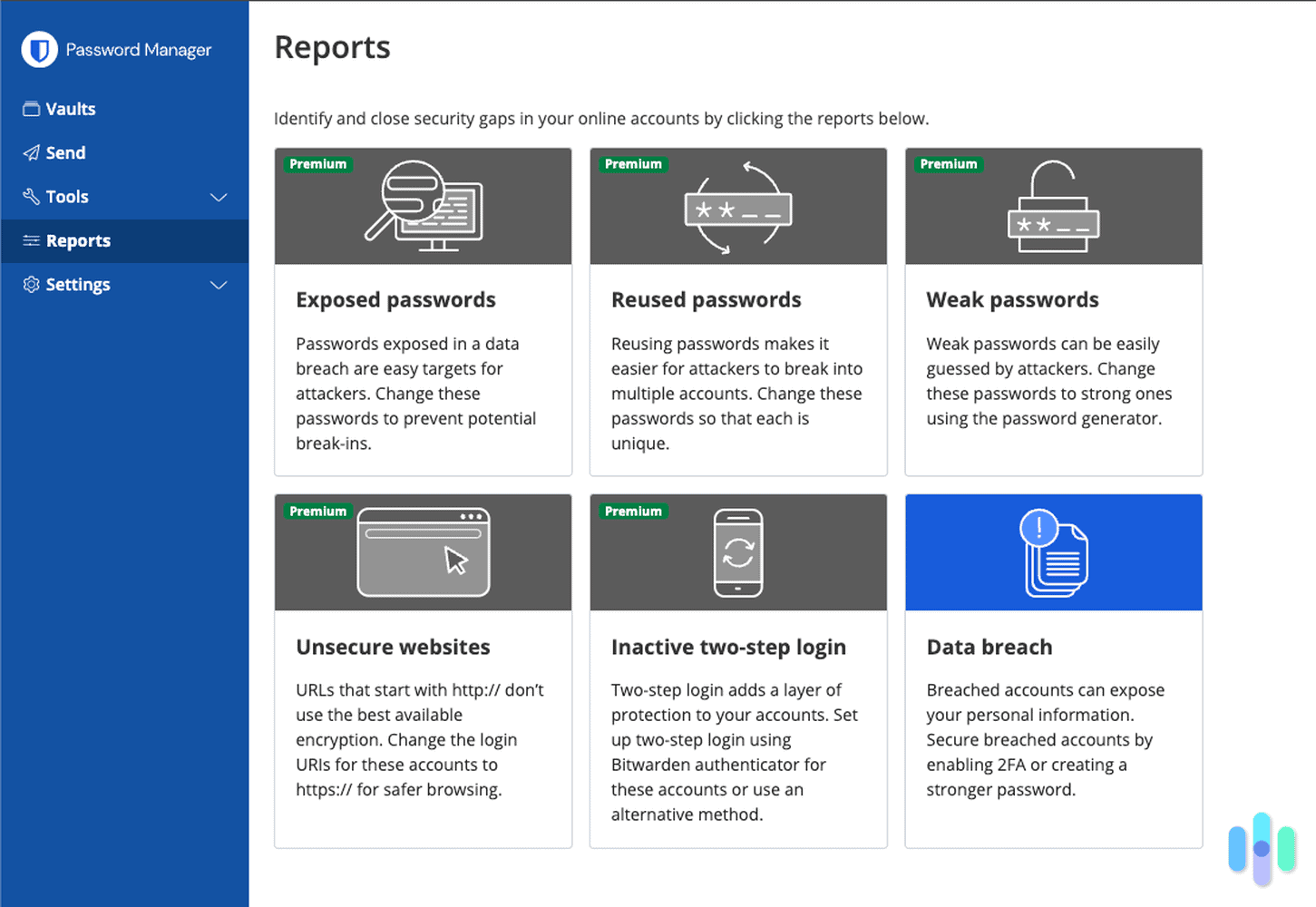

| Cybersecurity | No | No | Yes |

| Family Digital Safety | No | No | Yes |

| Triple Bureau Monitoring and Credit Reports | No | No | Yes |

| Individual Price | $9.99 per month | $17.99 per month | $19 per month |

| Family Price | $18.99 per month | $34.99 per month | $36 per month |

Family Coverage

For families looking to protect everyone under one plan, Allstate allows you to add coverage for up to ten family members. This gives a lot of flexibility, allowing you to cover everyone from your children to elderly parents. We recommend family plans to everyone who needs coverage for more than just themselves as child identity theft continues to grow more common. Additionally, elder fraud cost victims a total of $1.2 billion in 2024 alone.2 Allstate’s family plan offers protection for both.

Bundling Discounts

If you’re already an Allstate customer for auto, home, or other insurance products, you can potentially save on identity theft protection through bundling. Allstate offers various discount opportunities for customers who combine multiple services. While exact savings vary based on your location and specific coverage needs, bundling typically reduces overall costs by five to 25 percent. It’s impossible to know just how much we might have saved without contacting an agent first, but we like discounts and we’re not afraid to say it.

Recap

We’d rate Allstate Identity Protection as a solid choice for existing Allstate customers who want to consolidate their protection services. The service includes essential features like credit monitoring, identity monitoring, and the unique Digital Footprint tracker that discovers forgotten accounts. However, some significant gaps remain. The basic plans only monitor one credit bureau instead of all three, and they don’t provide regular credit reports or scores. Those features have become standards for the industry.

Choose Allstate Identity Theft Protection if you want:

- A company with a 90-year history of providing insurance

- Digital Footprint monitoring

- Social media monitoring

Avoid Allstate Identity Theft if you want:

- Three-bureau credit monitoring in lower-tier plans

- Regular access to credit scores and detailed credit reports

- Coverage for more than four family members

In the end, Allstate is a big name, but they’ll have to shore up some of these weaknesses if they want to impress us. If you’re looking for identity theft protection, we’d suggest checking out our list of the best identity theft protection services out there.

-

Globe Newswire. (2024). People have around 170 passwords on average, study shows.

https://www.globenewswire.com/news-release/2024/05/21/2885556/0/en/People-have-around-170-passwords-on-average-study-shows.html -

Federal Bureau of Investigation. (2024). Elder Fraud, in Focus.

https://www.fbi.gov/news/stories/elder-fraud-in-focus