LifeLock vs Zander ID Theft Protection

Which identity monitoring service is more trustworthy, LifeLock or Zander Insurance? Our experts weigh in.

Aliza Vigderman, Senior Editor, Industry Analyst

&

Aliza Vigderman, Senior Editor, Industry Analyst

&

Gabe Turner, Chief Editor

Last Updated on Oct 28, 2025

Gabe Turner, Chief Editor

Last Updated on Oct 28, 2025

- Full-service identity theft and credit monitoring

- Device protection with Norton 360 antivirus

- Reputation for outstanding customer service

- Affordable plans start at just $6.75 per month

- Up to $2 million in stolen funds reimbursement

- Unlimited recovery services with no time or monetary limits

How do LifeLock and Zander Insurance compare for identity theft protection? This article compares LifeLock vs Zander prices and features.

Before we delve into details, here are three takeaways from this comparison:

- Both LifeLock and Zander provide generous insurance policies. Their ID theft insurance can replace stolen funds, pay lawyers, and otherwise help restore your identity. Even better, Zander’s more affordable plans offer comparable or higher payouts than LifeLock’s mid-tier options.

- Zander is more affordable. This holds true for individual coverage and whole-family protection alike.

- LifeLock has a wider range of features. At all price tiers they include Norton 360 and at least single-bureau credit alerts. Zander doesn’t provide antivirus software or credit bureau alerts, but they can send alerts based on other sources.

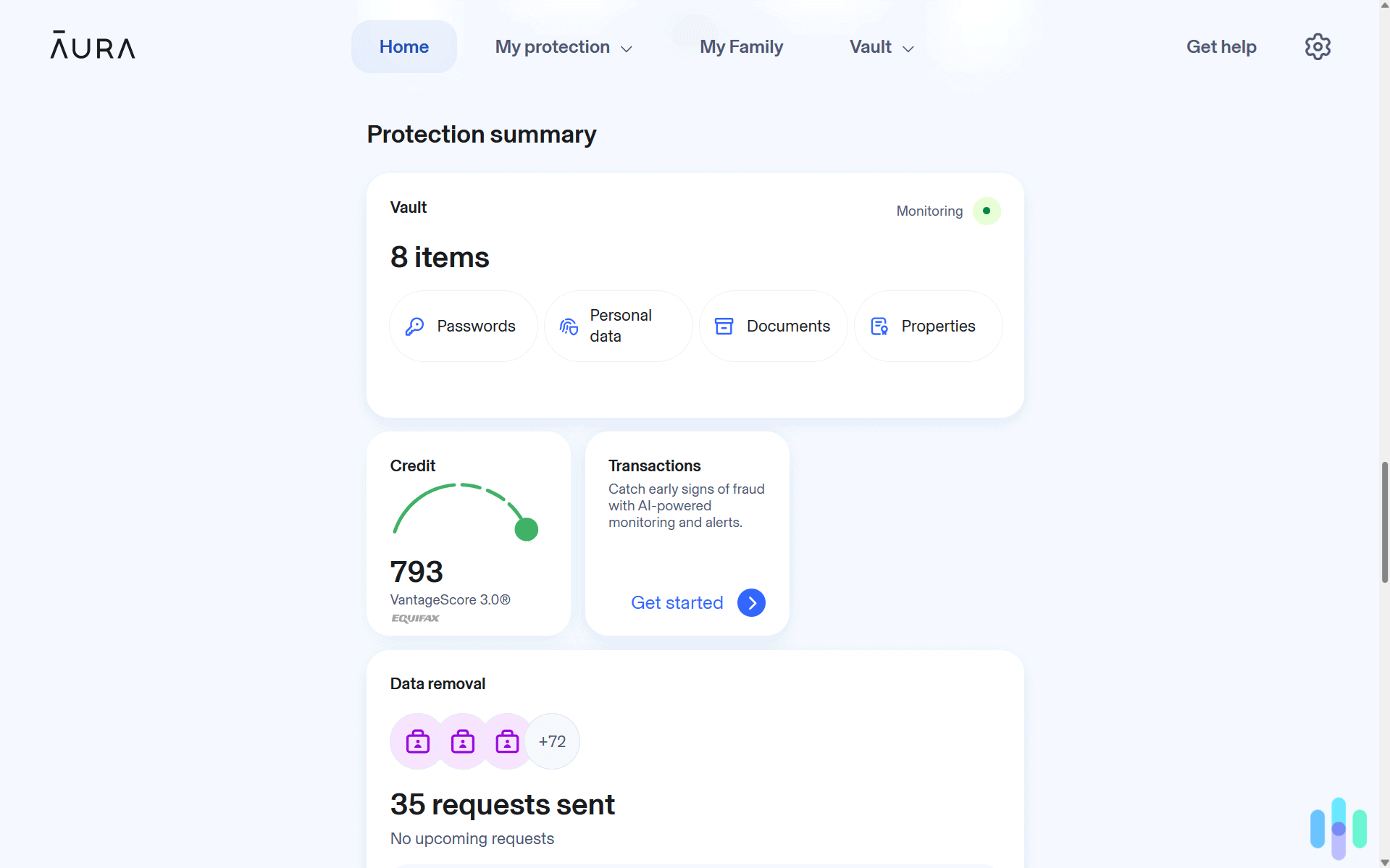

When evaluating Zander Insurance’s offerings, we found that they keep things refreshingly simple. They offer one comprehensive ID theft protection plan with straightforward pricing. You’ll pay $8.75 per month for individual adults or $15.50 per month for families. Annual plans reduce these costs to $8.25 per month for individuals or $14.58 per month for families.

LifeLock pricing is more complicated. The company regularly adjusts pricing and runs promotional offers. Currently, their three plans have introductory prices ranging from $11.99 to $34.99 per month per adult, with junior plans at $5.99 per month per minor. Keep in mind that LifeLock prices typically increase after your first year.

Next we give company overviews, explain Zander ID theft protection, and compare the Zander plan with all three LifeLock options.

Zander and LifeLock Company Profiles

Zander Insurance is a family-run business headquartered in Nashville, Tennessee. It touts itself as the only ID theft protection company endorsed by Dave Ramsey, a nationally syndicated radio personality focused on financial education for consumers. Zander is unique in other ways too:

- It’s the only fraud protection company we review that’s primarily an old-fashioned insurance agency. Along with ID theft insurance they can broker automobile insurance, homeowners insurance, life insurance, and other types of financial protection.

- Zander Insurance is much older than LifeLock and many other main competitors. It dates back to 1925 whereas others emerged in the Digital Age.

- The company is 49% employee-owned. Many competitors are more beholden to public shareholders.

Zander maintains an A+ rating from the Better Business Bureau and remains a BBB-accredited company. Assurant is their underwriter.

LifeLock is primarily focused on identity theft protection. The company was founded by two businessmen in 2005. Both entrepreneurs have moved on to other projects. The company is now owned by Gen Digital (formerly NortonLifeLock), which trades on NASDAQ under the ticker GEN. Gen Digital acquired the company in 2017 and has integrated LifeLock deeply with its Norton security products. Customer service is provided from Tempe, Arizona.

LifeLock is not BBB-accredited and has an A+ Better Business Bureau rating for 2024. The company lost some esteem in the 2010s when found guilty of misleading customers about the degree to which ID theft can be prevented. This scandal circles around those ads you might remember of the CEO sharing his social security number saying that LifeLock will still keep his identity safe. Well, it didn’t. Zander presents LifeLock’s troubled past as a reason for their own heavier focus on identity restitution versus ID theft prevention.

ID theft insurance from LifeLock is underwritten by AIG.

Zander Pricing & Cancellation vs LifeLock

With Zander, you get flexible payment options that actually save you money. Their current pricing structure makes protecting your identity budget-friendly:

- Individual Plan: $8.75 per month, or $99 with annual payment (Works out to $8.25 per month)

- Family Plan: $15.50 per month, or $175 with annual payment (Works out to $14.58 per month)

Yearly Zander subscriptions can be refunded on a prorated basis at any time. We think this flexibility makes the annual subscription particularly attractive. Even if you cancel midway through your subscription, you’ll receive a refund for the unused months. For instance, canceling after five months on an individual plan would net you a $49.50 refund for the remaining seven months.

LifeLock now offers both monthly and annual payment options. Prices range from $11.99 to $34.99 per adult each month during the first year of service. Just note that renewal rates are typically 20 to 40 percent higher. The company offers limited options for family plans. You can either choose a plan for two adults or a plan for two adults and five children. That doesn’t really cover many families, so we recommend tailoring your plan to your family with LifeLock Junior accounts for minors that cost $5.99 per month for each of your kids. LifeLock offers a refund only during the first 60 days of membership.

Read more about Lifelock in our 2025 LifeLock Identity Theft Protection Review.

Zander ID Theft Insurance

The Zander plan for ID theft protection has three main parts. It can:

- Monitor your accounts, the dark web, and other sources for signs of fraud

- Compensate you for stolen funds and other theft-related expenses

- Save your time by providing help with paperwork, phone calls, and other aspects of identity restoration

The benefits count as “comprehensive.” Still they’re not as broad as what some others provide, and that helps explain why Zander ID theft insurance costs less… even though their insurance payout can be higher.

Read more about Zander in our Zander Identity Theft Review.

What Can Zander Monitor?

While they don’t connect with credit bureaus, Zander Insurance can monitor a wide variety of sources for the early detection of identity fraud. Protection includes comprehensive dark web monitoring, which means Zander actively scans underground forums and marketplaces where cybercriminals trade stolen data. When your information appears in these spaces, you’ll receive immediate alerts along with expert guidance on next steps.

The company also monitors for the fraudulent use of your identity data in:

- Court records

- Employment applications

- Medical records

- Tax return filings

- Vehicle title applications

- And more

Types of data they can look for include your name, SSN, driver’s license number, phone number (up to five), and email address (up to five). The company also monitors change of address notifications filed with USPS.

Furthermore, Zander ID theft protection can monitor your accounts for signs of criminal targeting. Here are the types of accounts/numbers that you can have tracked for signs of mayhem:

- Bank accounts

- Credit and debit cards

- Email accounts

- Medical ID numbers

Zander scans its sources daily. If potential trouble is detected, they send alerts by email and/or via the Zander ID Theft Protection mobile app.

What’s Missing

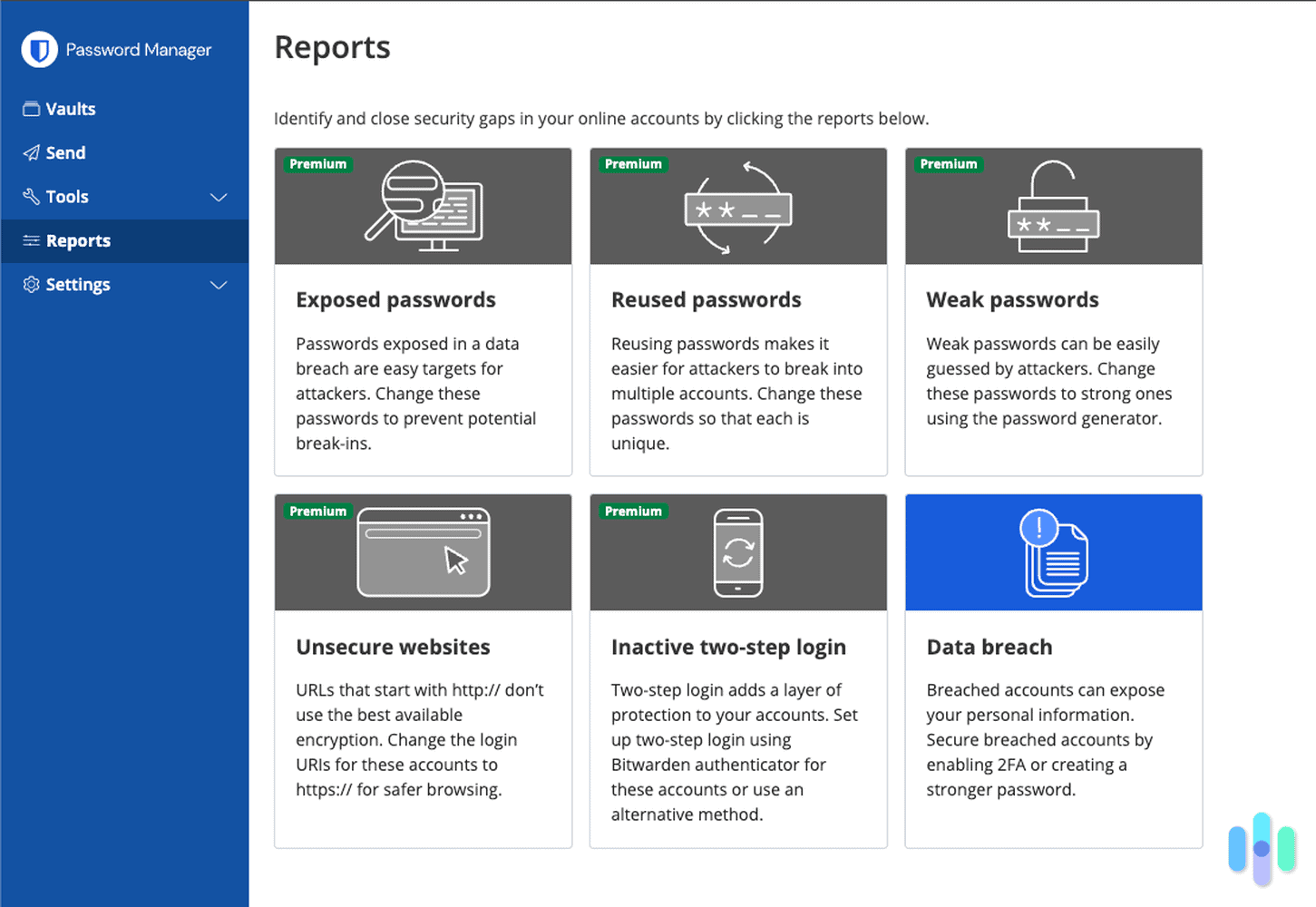

While Zander delivers solid monitoring capabilities, you won’t get direct credit bureau monitoring like you would with LifeLock’s premium plans. If you choose Zander’s cost-effective service, consider supplementing it with free credit monitoring services available through many credit cards or banks.

Thanks to federal regulations, you’re entitled to weekly free credit reports from all three bureaus through AnnualCreditReport.com. This changed from the previous annual allowance during the pandemic and has remained in effect. As Zander’s website points out, you can stagger your requests to get a free credit report every four months.

Compensation and Identity Restoration

Zander’s deal on ID theft protection is especially valuable in case trouble strikes. Each member is covered with a $1,000,000 insurance policy to replace stolen funds and another $1,000,000 policy to cover expenses incurred for ID theft restoration. The family plan comes with a $2,000,000 insurance policy to replace stolen funds.

The company can replace up to $10,000 per month in lost wages if you miss work due to identity restoration efforts. However, Zander ID theft insurance is meant to minimize your lost time. They’ll connect you with a certified ID fraud case manager, and this person can work on case resolution for up to three years.

You can assign limited power of attorney to let the case manager work with creditors, law enforcement, and others on your behalf. The person will also scan databases for other signs of crimes for up to three years.

Lost wallet service is part of membership too. If your wallet is lost or stolen, Zander can quickly deactivate and replace the credit and debit cards, SSN card, health insurance cards, and more.

More About Zander Family ID Protection

Compared with LifeLock, Zander provides especially affordable ID protection for families. With a $14.58 per month Zander policy, a “family” can include a primary adult member, a second adult, and up to 10 minors—significantly more inclusive than many competitors. Typically the second adult is the primary member’s spouse or partner, but the person could instead be their parent, sibling, adult child, or any other adult living at that address.

The primary member’s children can continue getting some benefits of the plan even after turning 18 years old; special clauses apply for adult children who remain dependent because they are in college full-time (through age 26) or have a disability.

Plans from LifeLock vs Zander

How does LifeLock compare with Zander? Their entry-level option, LifeLock Standard, now serves as the closest comparison point.

- For single adults, Zander Insurance offers better value: $8.25 per month versus LifeLock Standard at $11.99 per month (first year rate).

- For families, the gap widens considerably. Zander charges a flat $14.58 monthly for comprehensive family coverage, while LifeLock bills separately for each family member, easily exceeding $35 per month for a family of four.

LifeLock Standard vs Zander

Like the Zander plan, LifeLock Standard monitors the dark web and other sources for signs of identity theft. Regarding the “other sources,” each company has advantages over the other:

- Zander scans a wider variety of databases and will also track your financial accounts. Some monitoring features that Zander includes standard are only available with LifeLock’s most expensive Ultimate Plus plan.

- Only LifeLock can send alerts based on credit report changes. With LifeLock Standard, you’ll benefit from daily monitoring of your Equifax credit file.

A significant LifeLock advantage remains the inclusion of Norton 360 protection. A Standard subscription protects up to three devices with VPNs, password management, anti-malware protection, cloud backup, and comprehensive digital security features. Considering Norton 360 alone costs $9.99 monthly, we think the $11.99 LifeLock Standard plan delivers solid value for those who need both identity and device protection.

But how does coverage compare in case of trouble? Zander could provide almost $1M more. Here’s the breakdown:

LifeLock Standard

- $25,000 stolen funds

- $25,000 personal expense compensation

- $1,000,000 for lawyers and other experts in ID restoration

Zander ID Theft Insurance

- $1,000,000 for funds stolen through fraud, embezzlement, or forgery

- $1,000,000 for expenses incurred because of ID theft, such as lost wages; lawyers; travel; eldercare and childcare

In sum, LifeLock’s cheapest plan is more focused on ID theft prevention through computer safety. Zander has a more robust insurance plan and can monitor more accounts. This makes it our preference for comprehensive ID theft protection under $10 per adult, especially if you already have antivirus software or get credit monitoring through your bank.

LifeLock Select vs Zander

LifeLock Select is the company’s mid-tier offering. It starts at $19.99 per month per adult, jumping to approximately $29.99 monthly after the first year. Compared with LifeLock Standard, it expands ID theft compensation significantly, though it still doesn’t match Zander’s coverage. Select includes:

- $100,000 stolen funds

- $100,000 personal expense compensation

- $1,000,000 for lawyers and other experts in ID restoration

Other upgrades with LifeLock Select include court records monitoring, investment account activity tracking, and home title monitoring. These features can help you detect identity fraud across more channels. These services are included with the much more affordable Zander plan.

Additionally, LifeLock Select extends Norton 360 protection to ten devices instead of three, making it more suitable for households with multiple computers and smartphones.

All things considered, Zander delivers better value compared with LifeLock Select.

LifeLock Ultimate Plus vs Zander

The premium LifeLock plan, Ultimate Plus ($34.99 per month first year, then $44.99), provides the most comprehensive coverage in LifeLock’s lineup. It includes:

- $1,000,000 stolen funds replacement

- $1,000,000 personal expense compensation

- $1,000,000 for lawyers and other experts in ID restoration

Important premium features come with the Ultimate Plus upgrade: This plan delivers three-bureau credit monitoring with real-time alerts, monthly credit reports from all three bureaus, and credit scores. You’ll also get advanced monitoring for 401(k) and investment accounts, plus priority customer support. Zander, in contrast, doesn’t have the credit bureau and credit report options.

Furthermore with LifeLock Ultimate Plus you can install Norton 360 on virtually unlimited devices.

Compared with Zander, LifeLock Ultimate Plus gives more insurance, provides valuable credit bureau alerts, and can protect and backup all your computers and mobile devices. It costs roughly three times more than Zander but delivers comprehensive protection that many security-conscious consumers find worthwhile, especially those managing significant assets or multiple investment accounts.

Summary

Choosing between LifeLock and Zander ultimately depends on your budget and whether you prioritize prevention or recovery capabilities.

Generally speaking LifeLock places more emphasis on data protection with its Norton 360 perk, and Zander provides better value in case trouble strikes.

LifeLock has the edge in credit bureau alerts and credit bureau reports, but Zander offers bank account monitoring and other benefits for less.

Zander remains significantly more affordable, especially for families, and the price difference becomes even more pronounced after LifeLock’s first-year promotional rates expire.

Not sure if Zander or LifeLock is right for you? Read our guide about the Best Identity Theft Protection Services in 2025.

*LifeLock does not monitor all transactions at all businesses.

**Terms apply to all LifeLock plans.

***The credit scores provided are VantageScore 3.0 credit scores based on data from Equifax, Experian and TransUnion respectively. Any one bureau VantageScore mentioned is based on Equifax data only. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

****Reimbursement and Expense Compensation, each with limits of up to $1 million for Ultimate Plus, up to $100,000 for Select and up to $25,000 for Standard, when purchased in Norton 360 with LifeLock plans. And up to $1 million for coverage for lawyers and experts if needed, for all plans. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.